Overview of Business Structures

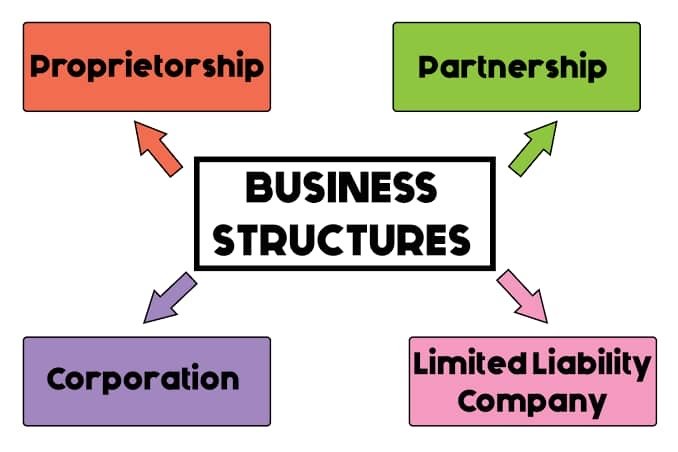

When starting a business, selecting the appropriate business structure is a critical decision that can significantly affect various aspects of operations, taxation, and liability. There are several types of business structures available, each with its own characteristics, advantages, and disadvantages. The most common structures include sole proprietorships, partnerships, limited liability companies (LLCs), corporations, and cooperatives.

A sole proprietorship is the simplest form of business structure, where an individual owns and operates the business alone. This structure is easy to set up and manage, as there are minimal regulatory requirements. However, the owner faces unlimited personal liability for any debts or legal issues the business incurs, which can be a considerable risk.

Partnerships involve two or more individuals sharing ownership and responsibility for the business. This structure can provide more resources and capital than a sole proprietorship. However, partners are also exposed to unlimited liability, meaning one partner’s actions could impact the entire partnership. It is crucial for partners to have a clear agreement outlining roles, responsibilities, and profit-sharing.

Limited liability companies (LLCs) combine the benefits of both partnerships and corporations. They offer limited liability protection to owners, which means personal assets are generally shielded from the business’s debts. Additionally, LLCs have more flexible management structures and fewer compliance requirements than corporations, making them an appealing choice for many entrepreneurs.

Corporations are more complex business structures that provide limited liability protection to shareholders. This means that personal assets are protected from business liabilities. However, corporations face more stringent regulatory requirements, such as regular board meetings and extensive record-keeping. They are often subject to double taxation, where profits are taxed at both the corporate level and again as dividends to shareholders.

Finally, cooperatives are businesses owned and operated by a group of individuals for their mutual benefit. Members of a cooperative share in the decision-making process and profits. This structure can be beneficial for businesses focused on community and collaboration, although it may be less common than the previously mentioned options.

Understanding the fundamental characteristics of these business structures is essential for aspiring entrepreneurs. Each structure has unique implications on liability, taxation, and operational flexibility, which should be carefully considered when choosing the right fit for a business endeavor.

Legal Implications of Business Structures

The legal implications of business structures play a crucial role in the decision-making process for prospective entrepreneurs. Each structure—whether it be a sole proprietorship, partnership, limited liability company (LLC), or corporation—comes with distinct legal responsibilities and protections. Understanding these differences is essential for minimizing legal risks and ensuring compliance with state and federal regulations.

In a sole proprietorship, the owner assumes full personal liability for business debts and legal obligations. This means that personal assets could be at risk should the business face lawsuits or financial troubles. In contrast, limited liability structures, such as LLCs and corporations, provide owners with a shield against personal liability. This protection means that, typically, personal assets are not subject to claims made against the business, thereby reducing financial risk to the individual.

Compliance requirements also vary significantly across different business structures. Corporations are subject to more stringent regulations, including regular reporting and taxation processes, while LLCs generally have fewer compliance obligations. Sole proprietorships and partnerships, while simpler to maintain, often lack the legal recognition required for certain business transactions. This can complicate matters such as entering contracts or securing loans.

Furthermore, the formation of legal documents is another critical aspect in choosing a business structure. For instance, corporations require articles of incorporation, while LLCs must file articles of organization. These legal documents not only establish the business entity but also dictate its operational framework, governance, and responsibilities. Additionally, the ownership of intellectual property, which can be a significant business asset, can be influenced by the chosen structure—highlighting the necessity for careful consideration of legal recognition. Thus, selecting the appropriate business structure is essential to mitigate risks and enhance operational efficacy.

Tax Considerations for Different Business Structures

When choosing a business structure, it is essential to understand the distinct tax implications associated with each option. Different structures, such as sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, have varying tax treatment that can significantly affect financial outcomes.

Sole proprietorships and partnerships benefit from what is known as pass-through taxation. This means that the business income is not taxed at the entity level; instead, it “passes through” to the owners’ personal tax returns. Consequently, the income is subject to the individual tax rates of the owners, which can lead to lower overall tax liability, particularly if the owners fall into a lower tax bracket. However, it is crucial to recognize that owners of these structures are personally liable for any business debts, which increases their personal financial risk.

On the other hand, corporations are subject to corporate tax rates, which may be higher than individual tax rates. This can lead to double taxation when profits are distributed to shareholders in the form of dividends, as both the corporation and the shareholders incur tax liability. To mitigate this, some business owners opt for S-corporation status, which allows income to be taxed similarly to a partnership, enabling pass-through taxation while still providing limited liability protection.

LLCs offer flexibility in taxation, as they can choose to be taxed as a sole proprietorship, partnership, or corporation, depending on what aligns best with their financial situation. By default, single-member LLCs are treated as sole proprietorships, providing pass-through taxation, while multi-member LLCs are treated as partnerships. However, if an LLC chooses to be taxed as a corporation, it will follow corporate tax rates.

In summary, the tax implications of various business structures play a vital role in overall financial health. It is essential to weigh the advantages and disadvantages of each structure in the context of potential tax liabilities to make an informed decision that aligns with long-term business goals. Seeking advice from a tax professional can further aid in navigating these complex considerations.

Choosing the Right Business Structure for Your Needs

Selecting the appropriate business structure is a critical decision that can significantly affect your entrepreneurial journey. One of the primary factors to consider is personal liability. Different structures, such as sole proprietorships, partnerships, corporations, or limited liability companies (LLCs), provide varying degrees of protection from personal liability. For instance, sole proprietors face unlimited liability, meaning personal assets may be at risk if the business incurs debts or is sued. In contrast, LLCs and corporations can offer limited liability protection, shielding personal assets from business obligations.

Another vital consideration is management preferences. Depending on how you wish to operate your business, certain structures may provide more suitable frameworks. For example, if you prefer a more hands-on approach, a sole proprietorship allows complete control. Conversely, a corporation requires adherence to a structured management protocol, including a board of directors and annual meetings. Understanding your management style and how it fits with different structures is crucial for ensuring smooth operations.

Taxation is also a significant factor. Various business structures face different tax treatment. Sole proprietorships and partnerships generally enjoy pass-through taxation, where profits are taxed once at the owner’s personal tax rate. However, corporations may face double taxation—once at the corporate level and again when dividends are issued. Familiarizing yourself with each structure’s tax implications can help you optimize your tax strategy, avoiding unforeseen liabilities.

In addition, it is essential to evaluate regulatory requirements within your industry. Some sectors impose specific regulations that may influence your choice. Finally, consider your long-term goals. As your business evolves, your chosen structure may need to adapt to changes in scale or market conditions. By assessing these factors—personal liability, management preferences, taxation, regulatory specifics, and long-term aspirations—you can make an informed decision about the business structure that aligns best with your vision.